Why It Might Be Time to Consider Investing in Infrastructure Assets (Hint: It’s All About Diversification)

SPONSORED CONTENT

When The Economist devotes its cover to “The Next Recession,” as it did last month, it might be time to consider making a few changes to your investment portfolio. For those looking to take some money off the table, diversifying into investments outside of today’s volatile public markets can be a good option.

The case for diversifying into infrastructure

Investing in infrastructure assets, particularly those that provide predictable cash flows, is a strategy long-used by institutional investors in times of market uncertainty. The Canada Pension Plan Investment Board, Canada’s largest pension plan for example, is increasingly shifting its capital to revenue-generating infrastructure.

When we say infrastructure assets, we’re talking about the real, physical infrastructure that make up our cities, and help our economy operate. These can include bridges and highways that enhance transportation, as well as energy generation facilities such as a natural gas plant that produces energy to light and heat our homes and buildings. These assets generally have high development costs, long operating lives, and secure cash flow streams.

You might not think of a toll road or a natural gas plant, for example, as being a sexy investment, but it’s their stable returns that make them attractive to investors. Infrastructure asset returns are generally not linked to the market: an energy generation facility will continue to heat your house regardless of how the TSX performs. Steady returns through the market cycle is one characteristic that make infrastructure assets “defensive” investments: they don’t outperform during strong bull markets, their strength is keeping their value during down markets.

CoPower Green Bonds: A green infrastructure investment for Canadians

For retail investors, opportunities to invest directly in infrastructure projects are typically few and far between, due to the high minimum investment requirements. Average Canadians can’t invest a few thousand dollars directly in a toll road project the way the Canadian Pension Plan Investment Board recently invested $1.89 billion in an Australian one.

CoPower Green Bonds are a new option for Canadian investors who want to invest in carbon-reducing infrastructure. CoPower’s 6-year, 5% Green Bond is backed by the steady, predictable returns of a portfolio of loans to operational* renewable energy and energy efficiency projects.

Real, revenue-generating infrastructure assets

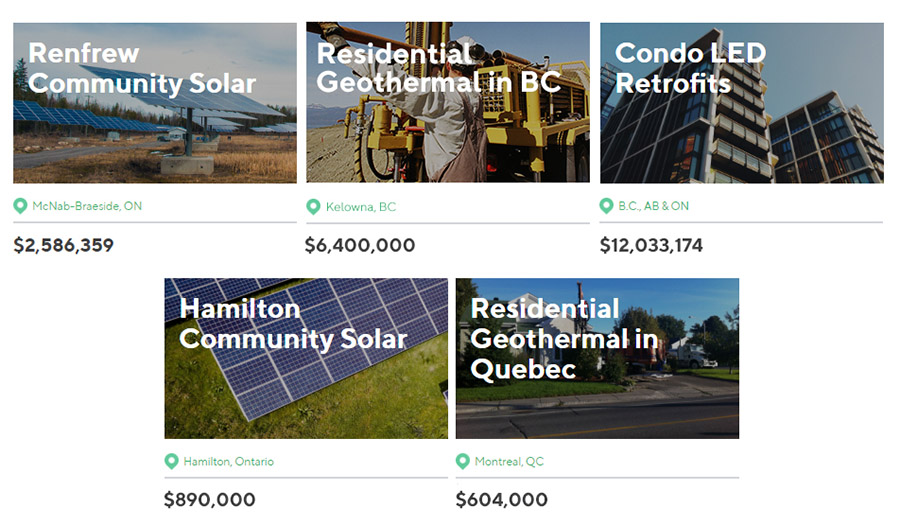

CoPower Green Bonds are backed by real assets: a diversified portfolio of senior, secured loans that, as of this month, contain more than 1,100 individual clean energy projects, including solar power generation, geothermal heating and cooling, and energy efficient building retrofits.

CoPower Finance Inc (the corporation that issues CoPower Green Bonds) uses a ring-fenced structure to lend to the project (or portfolio of projects), this structure is typical for infrastructure finance. Project revenues, earned from the sale of clean power or conservation services, are used to repay the loan. Those loan payments, in turn, generate the revenues used to pay interest to bondholders.

This model, supported by the excellent economics of renewable energy, allows CoPower to finance smaller renewable energy projects in an efficient manner and offer competitive fixed returns of 5% annually over a 6-year term.

To mitigate risk for bondholders, CoPower selects projects that use widely available commercial technologies and have strong contracts in place for the purchase of the clean energy or energy efficiency services. Of course, insurance, warranties and debt-service reserve funds are in place for added protection and to smooth payments in the rare event of a technical problem, default or delay in payment.

A private investment, uncorrelated to the public markets

As is the case with many infrastructure investment opportunities, CoPower’s bonds are private investments, meaning they aren’t traded on the public markets, and aren’t exposed to market sentiment. Therefore they can help diversify and reduce volatility in your portfolio by shielding some of your savings during a market downturn while still earning a steady fixed return.

It’s also important to note that because CoPower Green Bonds aren’t traded on a secondary market, investors must be comfortable holding the investment to maturity. As well, private investments are not subject to the same reporting requirements as the public markets, so investors may have less information to go on.

How to invest in Canadian clean energy infrastructure

In addition to the 6-year, 5% Green Bond, CoPower also gives investors the option of a 4-year, 4% Green Bond. Investors can customize their investment further by opting to receive either quarterly fixed payments of simple interest or compounding (reinvesting) those interest payments for a higher payout at the end of the term.

The entire process can be completed from the comfort of your home by creating an account and filling out an application online. Investors also have the option of investing via a TFSA or RRSP to maximize tax benefits; however it should be noted that most custodians (eg: financial institutions, wealth advisors, brokerage platforms) of registered accounts charge private placement and/or holding fees. The simplest and cheapest option for most investors is through Questrade.

To-date, more than 500 Canadians (including individuals and institutions) have invested nearly $25 million with CoPower. To learn more about CoPower Green Bonds, check them out here.

*CoPower may also lend to projects that are in the construction or installation phase, only where the risk is well understood and deemed moderate. Currently, CoPower’s Green Bond portfolio consists entirely of operating assets.