Stock Smarts: Small Gain For RRSP Portfolio

Photo: Pixabay

Most people look at their RRSPs only once a year, during the January-February contribution season. That’s a bad idea. Your RRSP is like any other investment portfolio – it needs to be reviewed on a regular basis, at least twice a year, and adjustments made when needed.

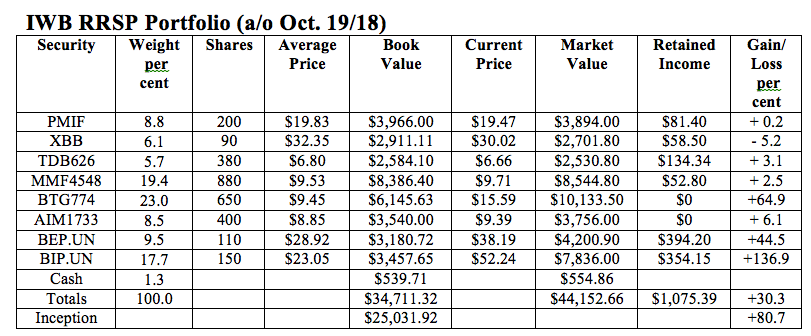

So, this week we’re taking a fresh look at my RRSP Portfolio, which was created in February 2012 for my Internet Wealth Builder newsletter with an initial value of $25,031.92. It has two main objectives: to preserve capital and to earn a higher rate of return than you could get from a GIC.

About a fifth of the portfolio is in bonds and cash. The balance is in growth-oriented assets that offer exposure to the Canadian, U.S., and international equity markets. The portfolio contains a mix of ETFs, mutual funds, and limited partnerships so readers who wish to replicate it must have a self-directed RRSP with a brokerage firm.

These are the securities currently in the portfolio with some comments on how they have performed since the last review in February. Stock results are as of the morning of Oct. 19. Mutual fund results are as of the close on Oct. 17.

PIMCO Monthly Income ETF (TSX: PMIF). This fund invests in a portfolio of global bonds and pays monthly distributions. It was added in February at $19.83. Since then, the unit value is down $0.36, reflecting rising interest rates. However, we received payments totalling $0.407 so we came out slightly ahead in the period.

iShares Canadian Universe Bond Index ETF (TSX: XBB). This ETF tracks the performance of the total Canadian bond universe including government and corporate issues. Bonds continue to be weak and this ETF is down $0.37 from our last review. But we received distributions of $0.591 per unit over the period, which left us with a small overall gain.

TD High Yield Bond Fund I units (TDB626). This high-yield bond fund was added in early 2017 in an effort to boost returns from our fixed income holdings. It has been a so-so performer; in the latest period the units were down $0.07 while we received $0.1745 in distributions.

Manulife Dividend Income Plus Fund Advisor Series (MMF4548). This is an equity fund with a small (14 per cent) bond position. I added it last February in place of the Fidelity Large Cap Fund, which was underperforming. About 56 per cent is invested in Canada, 20 per cent in U.S. stocks, with the rest scattered around amongst other countries. It’s ahead $0.18 since the last review plus we received distributions of $0.06 per unit.

Beutel Goodman American Equity Fund D units (BTG774). We continue to get good results from this entry. The unit value is up $0.57 since the last review. However, there were no distributions (these are only paid once a year, in December).

Invesco International Companies Fund, A units (AIM1733). This fund was added to the portfolio two years ago, under the Trimark name. It was recently changed to Invesco, but it’s the same fund. It has been on a slide recently, losing $0.81 in the latest period, and we did not receive any distributions. I’ll keep a close watch on this one; if it doesn’t start to improve we will look for a replacement.

Brookfield Renewable Energy Partners LP (TSX: BEP.UN, NYSE: BEP). This Bermuda-based limited partnership owns a range of renewable power installations (mainly hydroelectric but also some wind), mostly in North and South America. The share price dropped $1.92 in the latest period as rising interest rates negatively affected income-oriented securities. Because of timing, we received three distributions of US$0.49 per unit, for a total of US$1.47.

Brookfield Infrastructure Partners LP (TSX: BIP.UN, NYSE: BIP). This limited partnership invests in infrastructure projects around the world. It has recovered from a temporary slump and gained $1.42 in the latest period. We received three distributions totaling US$1.41, so we ended the period with a total gain of 5.6 per cent, not counting the exchange gain on the U.S. dollar distributions.

Interest. We invested $988.20 in an account with EQ Bank, which is paying 2.3 per cent. We received $15.15 for the period.

Here is how the RRSP Portfolio stood as of Oct. 19. Commissions have not been factored in and Canadian and U.S. currencies are treated at par for ease of tracking.

Comments: Our bond holdings continue to weigh on our returns but they provide the needed stability for an RRSP in the event of a market meltdown. Consider them as your insurance policy.

Despite this, the overall portfolio registered a modest gain of $716.85 for the period, or 1.6 per cent. That’s not great but this is a difficult period for a portfolio of this type.

In the six and a half years since this portfolio was launched the average annual gain is 9.4 per cent. That’s well in excess of our target, despite the weak returns of the past year.

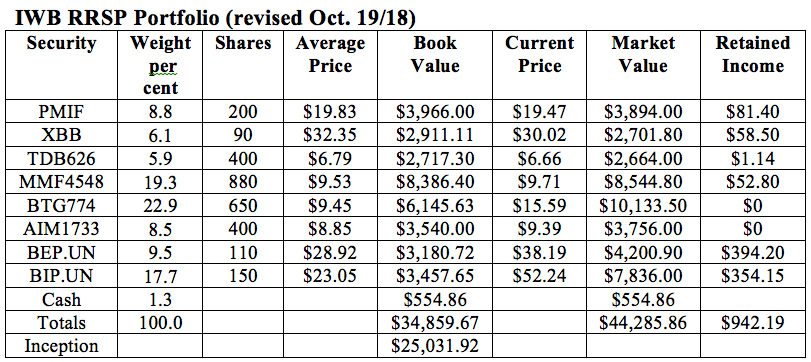

Changes: We will add 20 units to the TD High Yield Bond Fund, for a cost of $133.20. That will bring the total to 400 units and leave only $1.14 in cash. That’s the only change for now. We’ll see how the portfolio performs between now and February. If there is not a significant improvement, we’ll make some switches at that time.

We will reinvest our cash balance of $1,497.05 in the EQ Bank account, which still pays 2.3 per cent

Here is the revised portfolio. I’ll review it again in February.

Gordon Pape is Editor and Publisher of the Internet Wealth Builder and Income Investor newsletters. For more information and details on how to subscribe, go to www.buildingwealth.ca/subscribe