Stock Smarts: A Low-Risk Portfolio for When Fear Overtakes Greed

Photo: Pixabay

Everyone wants to be in the stock market when share prices are booming. But when things get rough, as they are right now, investors become much more concerned with safety. Fear overtakes greed.

I created a Low-Risk Portfolio last year at this time. The goal is to minimize any stock market losses while providing a return that is at least a point and a half better than the top GIC rate. Right now that is 3.75 per cent at FirstOntario Credit Union so our current target is 5.625 per cent.

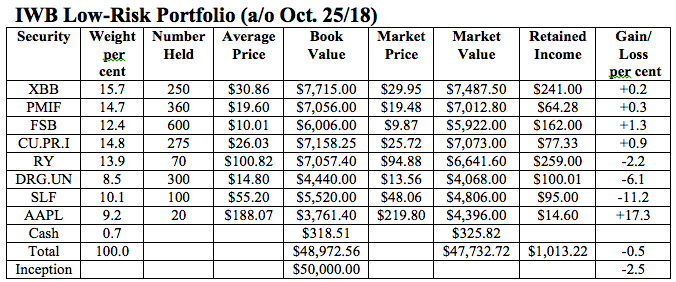

The portfolio is comprised of the following securities. Here is an update on their performance with prices as of the afternoon of Oct. 25.

iShares Core Canadian Universe Bond Index ETF (TSX: XBB). This ETF tracks the performance of the broad Canadian bond market, including both government and corporate bonds. Bonds continue to be under pressure as interest rates rise and the fund dropped $0.40 per unit in the latest period. However, we received almost as much in distributions (a total of $0.368) so the loss was fractional.

PIMCO Monthly Income Fund (TSX: PMIF). This ETF invests in non-Canadian fixed income securities from around the world. It too has been hit by rising rates, although the decline in unit value was a modest $0.12 since the last review in May. Distributions of about $0.18 a unit offset that and left us with a small gain for the period.

First Asset Enhanced Short Duration Bond ETF (TSX: FSB). This ETF invests in a portfolio that is divided between short duration high-yield securities and investment grade corporate bonds. It held its ground over the latest period, losing only $0.01 per unit. We received monthly distributions totalling $0.10 ($0.02 per month) so we ended up marginally ahead.

Canadian Utilities Rate Reset Preferred Shares (TSX: CU.PR.I). This is a rate reset from a leading utility company. It is down $0.31 since May when we added it to the portfolio. However, that was virtually offset by a dividend of $0.28.

Royal Bank (TSX, NYSE: RY). This is very unusual. Banks typically profit in a time of rising rates. But despite good earnings, Royal’s price is down $4.34 since March. We received one dividend of $0.94.

Dream Global REIT (TSX: DRG.UN). The REITs focuses on business properties in Europe. It was a strong performer in the early part of the year but the pressure of rising interest rates and the stock market sell-off knocked back the share price by $1.24 in the latest period. The distributions of about $0.33 per unit could not offset that.

Sun Life Financial (TSX, NYSE: SLF). Insurance companies should fare well in a rising interest rate environment but, as with Royal Bank, this is not proving to be the case so far. The stock is down $7.14 since we added it to the portfolio in May. We received two dividend payments during the period, for a total of $0.95.

Apple (NDQ: AAPL). Technology stocks took a beating in the market sell-off. Apple stock traded as high as US$233.47 in early October before investors decided tech had gone too far, too fast. But even with the pull back, we are still ahead by $31.73 a share since we added the stock to the portfolio in May. Also, we received one dividend of US$0.73.

Cash. We received interest of $7.31from the $762.71 held in our on-line account at EQ Bank.

Here is a summary of the portfolio. Commissions are not included and the Canadian and U.S. dollars are treated at par for ease of calculation.

Comments: The GIC won the first round as the portfolio incurred a small loss of 0.8 per cent during the latest period. Our bond ETF and preferred share holdings held their ground (including distributions) and Apple performed well. But we were hit by unexpected declines in the shares of Royal Bank and Sun Life, which were primarily responsible for the loss.

In the year since the portfolio was launched, we are down 2.5 per cent. The S&P/TSX Composite is down 5.9 per cent over the same period so we’re better on that score. But we’re well short of achieving our target goal, which is a point and a half better than the best five-year GIC rate.

The asset mix is quite conservative. Just over 58 per cent of the portfolio is invested in bonds, preferred shares, and cash. Another 24 per cent is in banks and insurance companies, which should rally as rates move higher.

Changes: The portfolio offers a good combination of modest growth potential with relatively low risk. It has not done well in its first year, but I expect it to improve going forward so I am not changing any of the basic components.

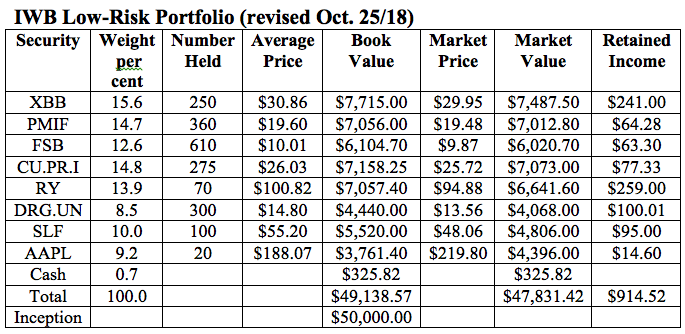

We will use a little of the accumulated cash to add to our position in FSB by spending $98.70 to buy another 10 units. That will bring our total to 610. Accumulated cash will drop to $63.30.

We are left with cash and retained earnings of $1,240.34, which we will keep in our EQ Bank account at 2.3 per cent.

Here is the revised portfolio. I will revisit it in April.

Gordon Pape is Editor and Publisher of the Internet Wealth Builder and Income Investor newsletters. For more information and details on how to subscribe, go to www.buildingwealth.ca/subscribe.