Gordon Pape: Advice on How to Overhaul Your RRSP Portfolio

Overhauling your RRSP can be a puzzle. Photo: Pixabay

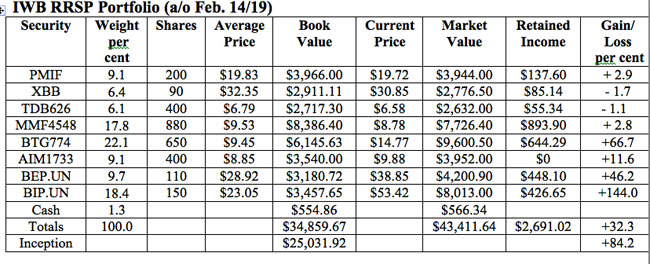

Now that you have (presumably) made your RRSP contribution for this year, the question becomes where should it be invested? For some ideas, let’s take a look at my model RRSP Portfolio. It was set up in February 2012, so this is its seventh anniversary.

The portfolio has two main objectives: to preserve capital and to earn a higher rate of return than you could get from a GIC. The original value was $25,031.92.

About a fifth of the portfolio is in bonds and cash. The balance is in growth-oriented assets that offer exposure to the Canadian, U.S., and international equity markets. The portfolio contains a mix of ETFs, mutual funds, and limited partnerships so readers who wish to replicate it must have a self-directed RRSP with a brokerage firm.

These are the securities currently in the portfolio with some comments on how they have performed since the last review in October. Stock results are as of the afternoon of Feb. 14. Mutual fund results are as of the close on Feb. 13.

PIMCO Monthly Income ETF (TSX: PMIF). This fund invests in a portfolio of global bonds and pays monthly distributions. It was added in February 2018 at $19.83. The unit value dropped over the summer, reflecting rising interest rates. However, the value has recovered by $0.25 since our last review in October plus we received dividends of $0.28 a share for a return of 2.7 per cent over the four months.

iShares Canadian Universe Bond Index ETF (TSX: XBB). This ETF tracks the performance of the total Canadian bond universe including government and corporate issues. Bonds have rebounded recently as the economy slows and central banks have signalled a pause in rate increases. The fund has gained $0.83 since the last review plus we received distributions of $0.296 per unit for an advance of 3.75 per cent in four months.

TD High Yield Bond Fund I units (TDB626). This high-yield bond fund was added in early 2017 in an effort to boost returns from our fixed income holdings. It has been a disappointment and to date we have a net loss of 1.1 per cent.

Manulife Dividend Income Plus Fund Advisor Series (MMF4548). This is an equity fund with a small bond position. About 52 per cent is invested in Canada, 27 per cent in U.S. stocks, with the rest scattered around amongst other countries. The NAV is down $0.93 since the last review but that was offset by distributions of $0.9558 per unit.

Beutel Goodman American Equity Fund D units (BTG774). The unit value is down $0.82 since the last review. However, we received a year-end distribution of just over $0.99 per unit in December so we had a net gain during the period.

Invesco International Companies Fund, A units (AIM1733). This fund had been on a slide but rallied modestly in the latest period to gain 5.2 per cent. It did not pay any distributions.

Brookfield Renewable Energy Partners LP (TSX: BEP.UN, NYSE: BEP). This Bermuda-based limited partnership owns a range of renewable power installations (mainly hydroelectric but also some wind), mostly in North and South America. The share price is up $0.66 since the last review and we received one distribution of US$0.49 per unit.

Brookfield Infrastructure Partners LP (TSX: BIP.UN, NYSE: BIP). This limited partnership invests in infrastructure projects around the world. It has been the best performer in the portfolio and recovered from a temporary slump to gain $1.18 in the latest period. We received one distribution of US$0.49.

Interest. We invested $1,497.05 in an account with EQ Bank, which is paying 2.3 per cent. We received $11.48 for the period.

Here is how the RRSP Portfolio stood as of Feb. 14. Commissions have not been factored in and Canadian and U.S. currencies are treated at par for ease of tracking.

Comments: Our bond holdings did somewhat better in the latest period as market rates slipped as both the Federal Reserve Board and the Bank of Canada indicated a pause in rate hikes.

The overall portfolio registered a modest gain of $874.61 for the period, or 1.9 per cent. In the seven years since this portfolio was launched the average annual gain is 9.1 per cent. That’s in excess of our target, despite the weak returns of the past year.

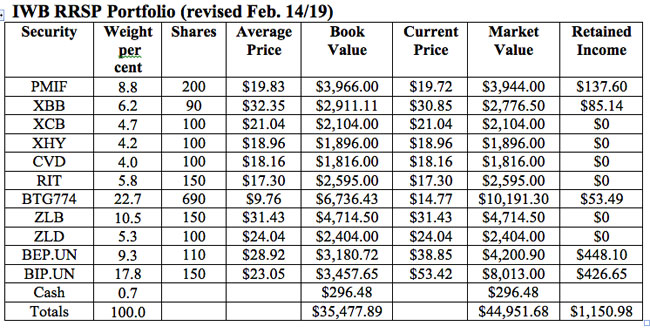

Changes: I’m going to do a major overhaul of this fund. I don’t do this often, but the portfolio has not been performing to my standards for a couple of years so it’s time for some changes. At the same time, this provides an opportunity to reduce the carrying costs of the portfolio by replacing mutual funds with ETFs.

For starters, we will sell three of our mutual fund positions: TD High Yield Bond Fund, Manulife Dividend Income Plus Fund, and Invesco International Companies Fund. This will give us $15,259.64 to reinvest. We will start by diversifying our bond holdings as follows:

iShares Canadian Corporate Bond Index ETF (TSX: XCB). This fund invests exclusively in corporate issues, as opposed to XBB, which covers the entire Canadian bond universe. It generated an average annual gain of 5.2 per cent over the 10 years to Jan. 31 and is ahead 2 per cent this year (to Feb. 14). The MER is 0.44 per cent. Distributions are made monthly and are currently $0.053 per unit. We will buy 100 units at $21.04 for an investment of $2,104.

iShares U.S. High Yield Bond Index ETF (CAD-Hedged) (TSX: XHY). High-yield bond ETFs can be volatile but over the years they have generated good results. This one was launched in January 2010 and has produced an average annual return of 5.65 per cent since inception. It’s coming off weak year but has been doing very well lately with a gain of 5.15 per cent so far in 2019. The MER is 0.67 per cent. Distributions are paid monthly, the most recent being $0.087 per unit. We will buy 100 units at $18.96 for an investment of $1,896.

iShares Convertible Bond Index ETF (TSX: CVD). This fund specializes in bonds that can be converted into common stocks under certain conditions. It has been around since 2011 with an average annual return since inception of 3.5 per cent. So far this year it is up about 2 per cent. Distributions are monthly at $0.07 per unit. The MER is 0.5 per cent. We’ll buy 100 units at $18.16 for a cost of $1,816.

Turning to equities, an RRSP should have some REIT exposure. There are several good choices available, including XRE from iShares. But we’re go with the First Asset Canadian REIT ETF (TSX: RIT). It’s more diversified (37 holdings as opposed to 18 for XRE) and has a better long-term track record. The MER is 0.75 per cent. The monthly distribution is $0.0675 per unit. We’ll buy 150 units at $17.30 for an investment of $2,595.

I also want to add a Canadian equity fund and an international fund to the portfolio to replace the two equivalent mutual funds. Here are my choices.

BMO Low Volatility Canadian Equity ETF (TSX: ZLB). This ETF invests in a portfolio of large-cap Canadian stocks that have a low beta history, meaning they are less sensitive to broad market movements and, therefore, less risky. Top holdings include companies like Fairfax Financial, RioCan REIT, Emera, and Intact Financial. This ETF invests in a portfolio of large-cap Canadian stocks that have a low beta history, meaning they are less sensitive to broad market movements and, therefore, less risky. Distributions are paid quarterly. The MER is 0.39 per cent. We will buy 150 shares at $31.43 for a cost of $4,714.50.

BMO Low Volatility International Equity Hedged to Canadian Dollar ETF (TSX: ZLD). I like low-volatility funds for an RRSP for one very simple reason: they are designed to mitigate losses in bad markets. The worst enemy of your retirement plan is a serious setback, such as many people experienced in 2008. So, let’s stick with the same theme for international investing with another fund from BMO. It’s hedged to Canadian dollars, so the currency risk is removed. This fund has not been around long, but it shows a two-year average annual return of 9.2 per cent, which is very good in the context of global markets. It invests in units of ZLI, a companion low-volatility fund that is unhedged. Distributions are paid quarterly, and the MER is 0.45 per cent. We will buy 100 units at $24.04 for a total of $2,404.

That brings our total new investment to $15,529.50. We’ll take $269.86 from cash to make up the difference.

Finally, we will buy another 40 units of the Beutel Goodman American Equity Fund at $14.77 for a cost of $590.80. That will leave retained earnings of $53.49.

That leaves a cash balance (including retained income) of $1,447.46, which will keep in our EQ Bank account at 2.3 per cent.

Here is the revised portfolio. I’ll review it again in August.

RELATED:

Q&A With Gordon Pape: Will A Spousal RRSP Reduce My Tax Bill?

Do you have a money question you’d like to ask Gordon? Find out how to submit it here and then check out our Money section regularly to see if it was chosen for a response. Sorry, we cannot send personal answers.