How the Biggest Brands Can Have a Big Impact on Your Income

SPONSORED CONTENT

Think about your favourite brand of computer or handheld device. You can probably list several reasons why you’ve fallen in love with that particular brand. Perhaps it’s durability, dependability, intuitive functionality, value for money, innovative features, the company’s commitment to customer service—or a combination of all of the above. Whatever it is that drew you to the brand and has kept you, and millions of others, satisfied and willing to invest in new product offerings year after year is the reason that brand is successful.

And that strong, dependable brand that works so well for you in your home or office, can also work hard for you in a different way.

The world’s most recognizable brands have an impressive track record. They attract some of the best talent on the globe, distribute their products worldwide, and inspire long term brand loyalty among customers (remember how easy it was for you to list all the reasons why you love your laptop and devices?). This naturally makes these brands among the most sought-after investments. But another reason for their popularity is their stock’s ability to ride out a potential correction in an aging bull market. They seem to have the ability to perform consistently no matter what, generating dividend income in both good times and bad.

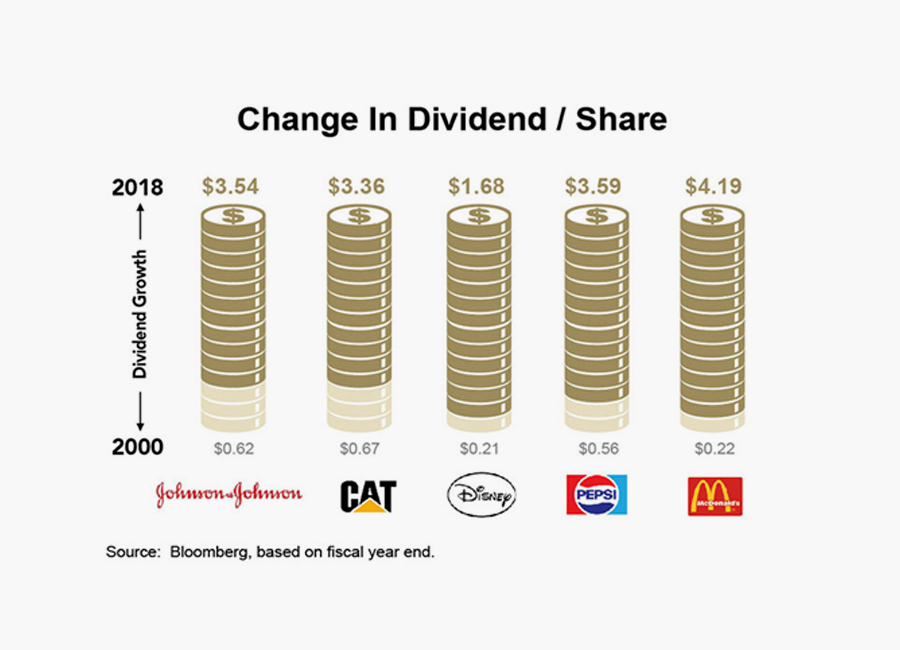

Brands like The Walt Disney Company, Nike, Apple, and Johnson & Johnson all have several key things in common: they transcend geographic and cultural borders, they have a long record of dividend payments, they have an established record of stable earnings power, and they can offer safe harbour during economic adversity.

They are also all included in the Harvest Brand Leaders Plus Income ETF.

Owning good quality businesses over the longer term is part of Harvest Portfolios Group’s philosophy. Using financial data and metrics, they begin by selecting the best of the world’s 100 leading global brands for the Harvest Brand Leaders Plus Income ETF. Through various analysis, the field is narrowed down to 65, and finally to a core 20 using very specific and exacting criteria. Those 20 brands must generate a five-year return on equity growth that is higher than the average in the initial 65-name cut, have a price-earnings multiple that is lower than the average, and a dividend yield that is higher than the average.

For a potential investor, one of the most compelling things about these 20 handpicked brands is the fact that their global reach and recognition allows them to benefit from diversified world dynamics and increasing demand for their products in an environment of rising global growth.

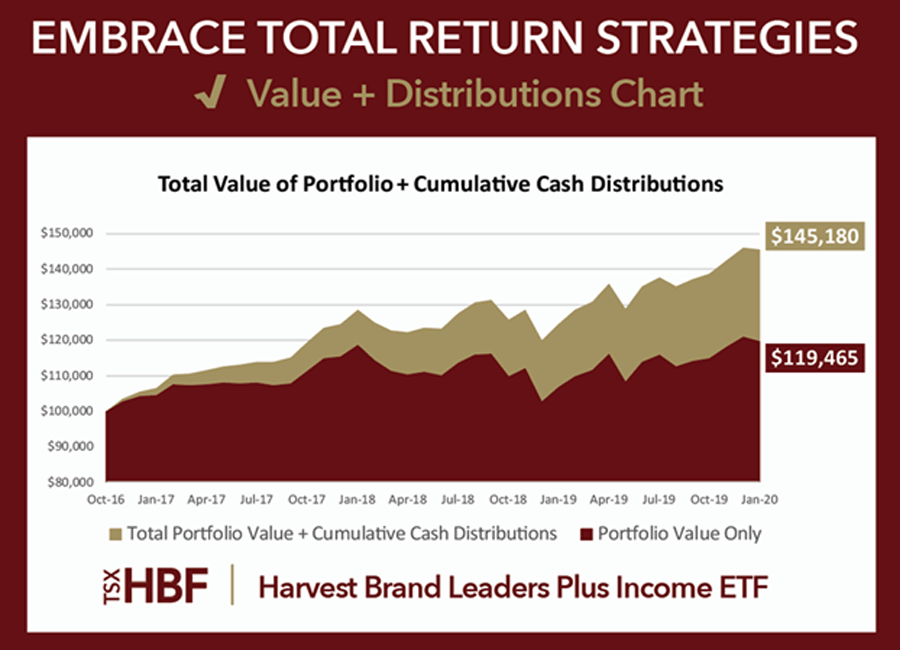

That potential for stable growth translates into a reliable source of income for you—something that’s incredibly important when you’re retired or soon to be retired, because investment goals naturally change when you reach that point in your life. When you’re working, it’s all about accumulating assets. When you retire, the goal shifts to preserving what you have and finding ways to generate a monthly income to live on. Harvest’s focus on owning historically strong, leading companies that grow and generate a steady income over time is how they build wealth for their clients.

So that Smartphone you simply can’t live without might belong to a brand that will play a role in ensuring that your retirement years are as financially secure as possible.

The big picture: Price Value plus Distributions

Harvest Brand Leaders Plus Income ETF (HBF)

Disclaimer:

For illustrative purposes only. Assumes a $100,000 investment when the Harvest Brand Leaders Income Plus ETF (“HBF”) commenced trading on the Toronto Stock Exchange. The chart above only shows the market value per unit of HBF using the daily market close on the TSX and identifies the monthly cash distributions paid by HBF on a cumulative basis. The cash distributions are not compounded or treated as reinvested, and the chart does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder. The chart is not a performance chart and is not indicative of future market values of HBF or returns on investment in HBF, which will vary.

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.) The ETFs are not guaranteed, their values change frequently and past performance may not be repeated. Please read the relevant prospectus before investing. Tax, investment and all other decisions should be made with guidance from a qualified professional.

Talk to your financial advisor for more information and visit Harvest at http://pages.harvestportfolios.com/harvest-brand-leaders-plus-income-etf-tsx-hbf-hbf-u/

Web URL: https://harvestportfolios.com/

Twitter link: @harvestetfs

LinkedIn Link: https://www.linkedin.com/company/harvest-portfolios-group