Redefine Retirement with the Longevity Pension Fund

CARP RECOMMENDED PARTNER SPONSORED CONTENT

When we leave behind the workforce, it is too often the assumption that we also leave behind our desire to build, our longing for self-improvement, and our hunger to make an impact.

Maybe this false belief is the reason that our financial services sector has ignored the problem of income security in our post-work years, despite the demographics of the world quickly changing. We’re living longer, more vibrant lives and over 1,000 Canadians turn 65 every day!

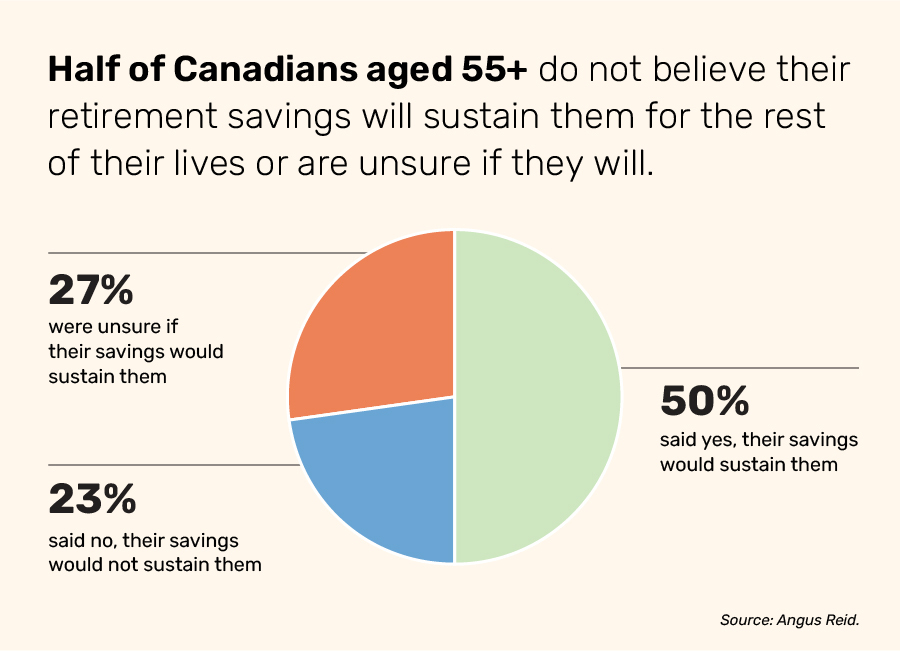

Yet, people struggle to find sustainable retirement solutions. According to a new survey from Purpose and Angus Reid, 50% of Canadians aged 55+ are not confident that they will have enough money to last them in retirement. And the pandemic has only intensified these fears, with one-in-five Canadians aged 55+ claiming they have had to withdraw funds, delay retirement, or stop contributions to their retirement savings due to the pandemic.

At Purpose Investments, we want to solve the problem of income instability in your post-work years. We’re here to tell a new story and redefine retirement, because we believe that people retire their jobs, but never retire their ambition.

It’s why we created the Longevity Pension Fund®, the world’s first mutual fund designed to incorporate similar risk pooling mechanics as pension plans and provide income for life for Canadian retirees.*

The Longevity Pension Fund is like a pension fund that’s accessible to anyone. Incorporating key features of existing retirement products, the fund allows you to redeem your investment to access your invested capital at any time.** You can expect regular payments even if you don’t have a defined-benefit pension plan at work, or the plan you have is inadequate.

Like any mutual fund, the fund is available for every Canadian investor to own and can be held in both registered and non-registered accounts.

With the Longevity Pension Fund, you can expect payments every month for as long as you live, starting at 6.15% annually for individuals 65 years of age. The best part? Payments are designed to increase over time.* Because life should get better with age.

At Purpose Investments, we aim to solve the issue of income instability for retirees so we can live in a world where more Canadians can see retirement as an opportunity, not a challenge.

This fund is designed to help individuals maximize their income security, optimize their finances towards their life goals, and get the most out of the money they’ve accumulated once they retire.

Our hope with Longevity is that people will have a happier retirement because they know that their income will last regardless of whether they live 10 years or 40 years post retirement.

The Longevity Pension Fund is recommended by the Canadian Association of Retired Persons (C.A.R.P.). To learn more, please visit www.retirewithlongevity.com.

An online survey of 1,503 Canadians was completed in May 2021, using Angus Reid’s online panel. For comparison purposes, a probability sample of this size has an estimated margin of error (which measures sampling variability) of +/- 2.4%, 19 times out of 20.

* Although distributions are designed to increase over time, they may go up or down. The frequency and value of distributions is not guaranteed with the Fund. Distribution levels will be assessed regularly, and impacted by market conditions and unitholder redemptions (both voluntary and due to death).

** It is important to note that the Fund has a unique redemption structure compared to other mutual funds. Most mutual funds redeem at their associated Net Asset Value (NAV). In contrast, redemptions in the decumulation class of the Fund (regardless of whether the redemption is voluntary or at death) will occur at the lesser of NAV, or the initial investment amount less any distributions received. Fees may apply.

The Longevity Pension Fund is managed by Purpose Investments Inc. Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. The prospectus contains important detailed information about the investment fund – always read the prospectus before investing. As with any investment, there are risks to investing in investment funds. There is no assurance that any fund will achieve its investment objective, and its net asset value, yield, and investment return will fluctuate from time to time with market Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Distributions are not guaranteed, and levels and frequency of distributions may increase or decrease from time to time.

® Registered trade-mark of Longevity Funds International Inc.; used under license.