Tackling the Retirement Crisis with Income for Life

CARP RECOMMENDED PARTNER SPONSORED CONTENT

Retiring is a huge milestone, but instead of celebrating it, many Canadians are anxious about the transition to their post-work years.

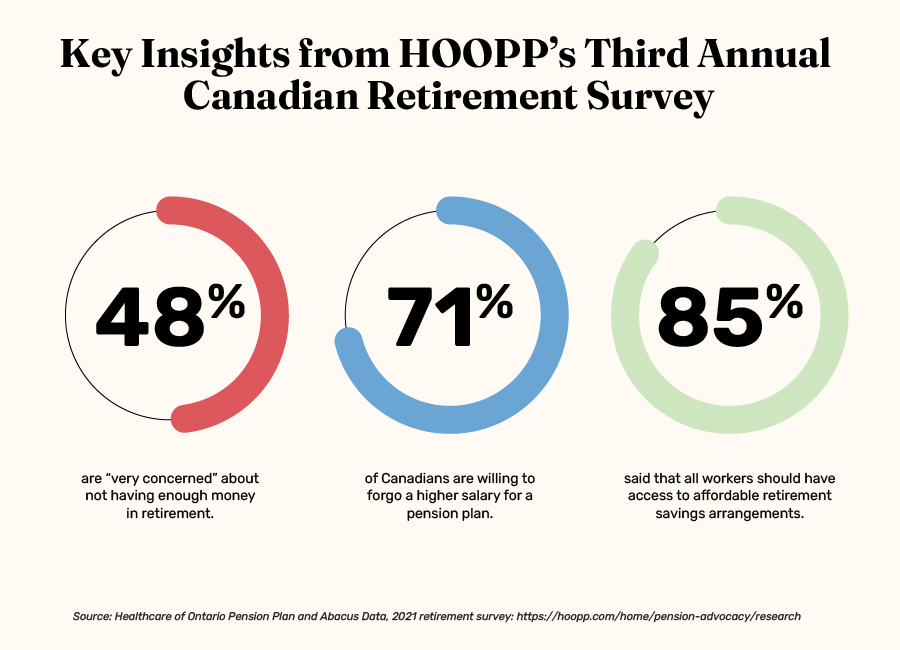

According to the 2021 retirement survey from the Healthcare of Ontario Pension Plan, concerns about retirement remain greater than concerns about health, debt, and job security. This remains true for Canadians of all income levels: be it those making $50K or less (where 52% cited they were “very concerned”) or those making over $100K (where 42% of respondents replied in kind).

Money anxiety often tops the list of retirement worries, especially as many of us don’t have a defined-benefit pension plan at work that guarantees we’ll have income for the rest of our lives.

The financial services community has coined this issue as “the problem of decumulation.” Decumulation is the drawdown of savings to provide an income stream in retirement. Since retirees no longer earn a regular income, they instead rely on accumulated savings to finance their retirement lifestyle.

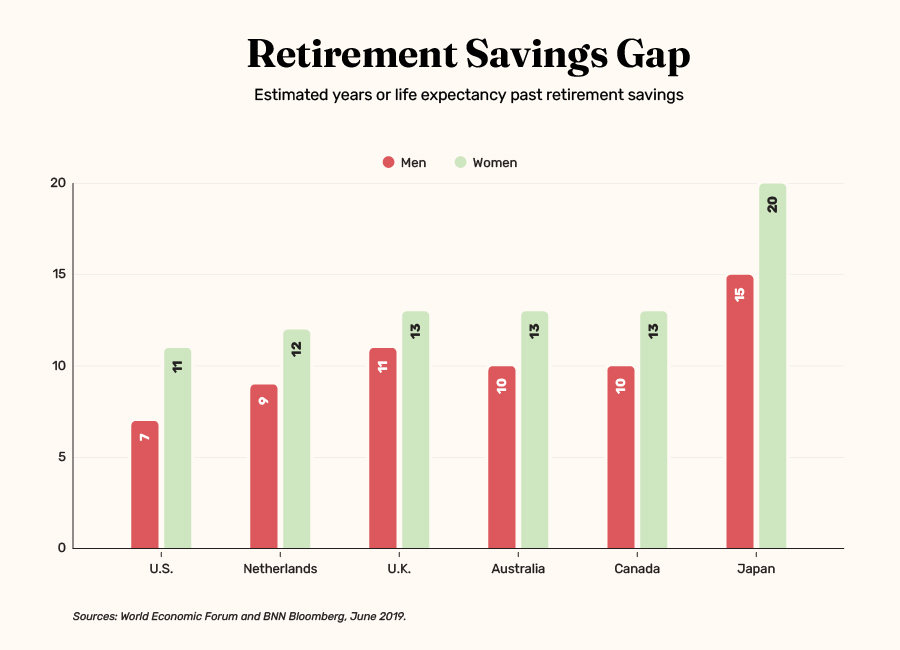

There have traditionally been few effective solutions to the problem of decumulation, leaving retirees to fend for themselves to achieve long-term financial security. This has been a contributing factor to retirement savings gaps around the world.

As illustrated above, the average Canadian risks running out of money about a decade before they die. The problem is even worse for women, who on average live longer. But this problem can’t be blamed on any one individual or their saving strategy.

The problem of decumulation is a systemic, structural issue surrounding retirement planning options offered around the world. Studies state that the size of the world’s collective retirement savings gap could exceed US$400 trillion by 2050.1 Yes, that’s trillion with a “T”.

At Purpose Investments, we aim to solve the problem of decumulation with the Longevity Pension Fund, which is a mutual fund designed to provide similar benefits of a defined benefit pension plan so all Canadians may access a lifetime income stream in retirement.

This first-of-its-kind solution provides income for life and is redeemable at any time. By incorporating the concept of longevity risk pooling, the Longevity Pension Fund helps close the retirement savings gap by grouping people’s individual risks of outliving their savings.

If you’re 65 and invest, your initial income rate is targeted at 6.15% and designed to increase over time.* And although the distribution levels are not fixed, we believe this is one of the Longevity Pension Fund’s strongest design features.

By not locking the distribution rate at a fixed level, market gains can be passed to investors through higher distribution levels as time passes. This structure also allows retirees (or their estates) to recover the lesser of their net asset value or their unpaid capital** (i.e., their initial investment less the payments received), providing a level of flexibility not granted with traditional lifetime annuities.

There are other solutions to help with decumulation, like buying annuities, deferring government pension programs, accessing home equity, and so on. However, if you are looking for a flexible solution that provides income for life, please reach out to see if the Longevity Pension Fund is right for you: retirewithlongevity.com/contact-us.

Sources:

1 “Retirees risk running out of money a decade before death,” BNN Bloomberg, June 2019: https://www.bnnbloomberg.ca/retirees-risk-running-out-of-money-a-decade-before-death-1.1272545

* The Fund has a unique mutual fund structure. Most mutual funds redeem at their associated Net Asset Value (NAV). In contrast, redemptions in the decumulation class of the Fund (whether voluntary or at death) will occur at the lesser of NAV or the initial investment amount less any distributions received. You can always access the lesser of unpaid capital (initial value of your investment less any income payments made) or your net asset value. Fees may apply. Please review the prospectus or speak to your advisor for more details.

**Although distributions are designed to increase over time, they may go up or down and are never guaranteed. The level will be assessed regularly, and impacted by market conditions and unitholder redemptions (both voluntary and due to death). For individuals 64 years and younger, investment returns are reinvested, and distributions begin in the month after turning 65 years old. The calculator assumes an annualized net return of 3.75%. The income payments shown are gross of taxes. Please review the prospectus or speak to your advisor for more details.

Forward-looking statements are not guaranteed

Certain statements on this page may be forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose believes to be reasonable assumptions, Purpose cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

The content of this document is for informational purposes only, and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained on this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable, however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice and neither Purpose Investments Inc. nor is affiliates will be held liable for inaccuracies in the information presented.