ETF Launches with Target Yield of 8.5% to Help Canadians Get the Income They Need

Fixed income isn’t working anymore, but one new ETF offers hope.

The old rule of the 60/40 portfolio worked for decades. The wisdom was, if you put 60% of your holdings in stocks, and 40% in bonds, you’d have a balanced portfolio that would grow long-term and the income paid by those bonds would be enough to finance your retirement.

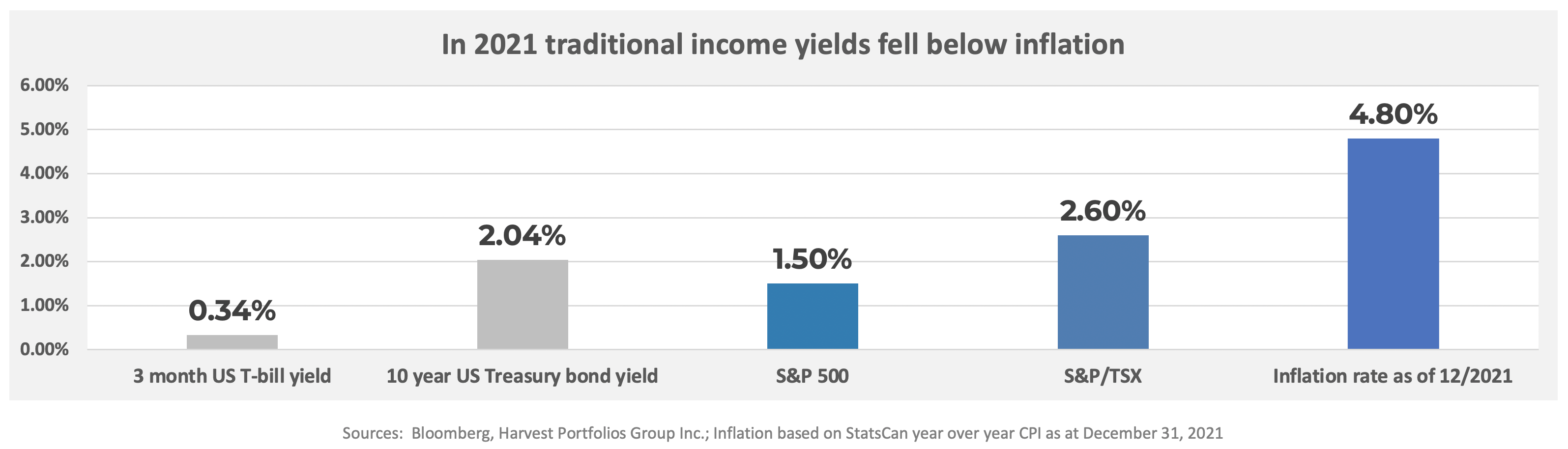

In the past decade, historically low interest rates have erased much of the income your bonds promised. Now, high inflation means the paltry income your bonds are paying can’t keep pace with the cost of living.

Harvest ETFs has been working hard to address your need for income-paying investments.

Harvest ETFs is an independent ETF provider with a proven track record of providing that income through their simple, effective, equity income ETFs. These ETFs generate income from stocks, by combining portfolios of great companies with a covered call strategy that provides investors with long-term growth prospects while they get consistent monthly income.

Equity Income ETFs play to both sides of the old 60/40 portfolio. Like bonds, they generate income, though generally at a higher rate. However, they are portfolios of equities, stocks with growth prospects in the long term. Because of the mechanics of the covered call, which you can read about here, some of the growth generated by holdings in these ETFs will be offset. Therefore, when assessing performance of your investments, it’s crucial to examine both the growth of your investment and the income it has paid you over time. It’s important to always consider income because, in this environment, income is what so many Canadian investors need.

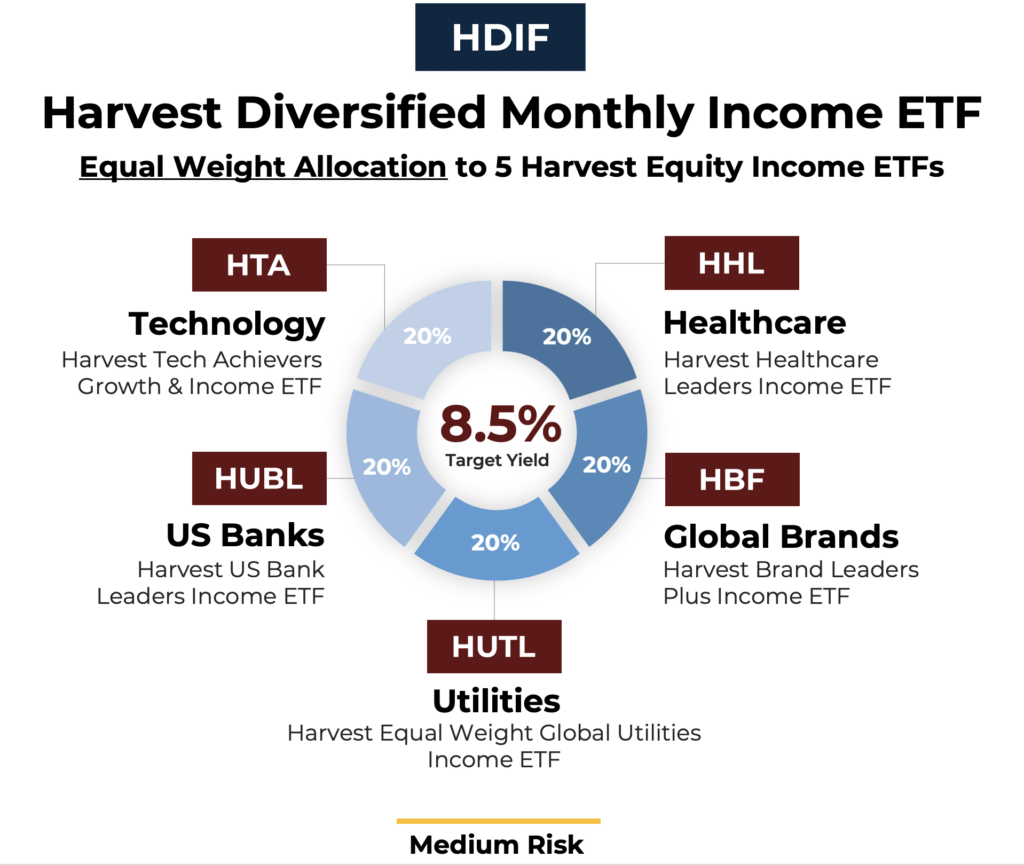

Harvest’s latest ETF, the Harvest Diversified Monthly Income ETF (HDIF:TSX), is purpose-built to meet Canadians’ need for steady, tax-efficient income. It’s an ETF that combines 5 proven strategies in a competitively priced single-ticket package with a target annualized income yield of 8.5%.

HDIF is comprised of an equal weight combination of five Harvest Equity Income ETFs: the Harvest Healthcare Leaders Income ETF (HHL:TSX), the Harvest Brand Leaders Plus Income ETF (HBF:TSX), the Harvest Tech Achievers Growth & Income ETF (HTA:TSX), the Harvest Equal Weight Global Utilities Income ETF (HUTL:TSX) and the Harvest US Bank Leaders Income ETF (HUBL:TSX). Each of these equity income ETFs has a proven track record of giving investors simple, tax-efficient income and long-term growth opportunities.

Crucially, these are also all comprised of high-quality companies in important and tangible sectors. Each holding in a Harvest ETF must meet a strict set of financial criteria. Each of the ETFs in HDIF enjoy strong performance catalysts that are tied to the way we live our lives every day. We all need healthcare, we all use technology, we all rely on banking services, we all buy from major brands, and we all need the lights to turn on and the water to flow from our taps.

Simply put, HDIF gives you exposure to those five robust sectors. This is a portfolio of over 90 high quality companies, diversified across sectors and geographies to offset volatility. It incorporates Harvest’s proven track record of maximizing income yields with covered call strategies and uses modest leverage to maximize the cashflow investors need in a registered-account eligible product.

Visit Harvest’s website to learn more about how HDIF can help meet your income needs.

For a steady stream of news and insights from Harvest, subscribe to their newsletter.

Twitter: @harvestetfs

LinkedIn: https://www.linkedin.com/company/harvest-portfolios-group

Facebook: https://www.facebook.com/HarvestETFs

Disclaimer

For Information Purposes Only. Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The ETF is not guaranteed, its values changes frequently and past performance may not be repeated. This communication should not be considered as advice and/or a recommendation to purchase or sell the mentioned securities or used to engage in personal investment strategies. Tax, investment and all other decisions should be made with guidance from a qualified professional.

Certain statements in this communication are forward looking Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS.FLS are not guarantees of future performance and are by their nature based on numerous assumptions, which include, amongst other things, that (i) the Fund can attract and maintain investors and have sufficient capital under management to effect their investment strategies, (ii) the investment strategies will produce the results intended by the portfolio managers, and (iii) the markets will react and perform in a manner consistent with the investment strategies. Although the FLS contained herein are based upon what the portfolio manager believe to be reasonable assumptions, the portfolio manager cannot assure that actual results will be consistent with these FLS. Unless required by applicable law, Harvest Portfolios Group Inc. does not undertake, and specifically disclaim, any intention or obligation to update or revise any FLS, whether as a result of new information, future events or otherwise.