Stock Market: This Growth Portfolio Averages 25%

Photo: Austin Distel/Unsplash

My Internet Wealth Builder newsletter covers a broad range of securities, reflecting the varying priorities of our readers.

Some people are looking for safety, others for income, still others for maximum growth potential.

For the latter group, we created the Internet Wealth Builder Growth Portfolio in August 2012 with an initial value of $10,000. It has performed very well, despite a setback in the last reporting period that covered the six months to March 6.

While the returns have been far in excess of our initial target of 12%, this is a risky portfolio, with 100% exposure to the stock market and a focus on momentum plays. So, it should only be used by readers with a high risk tolerance.

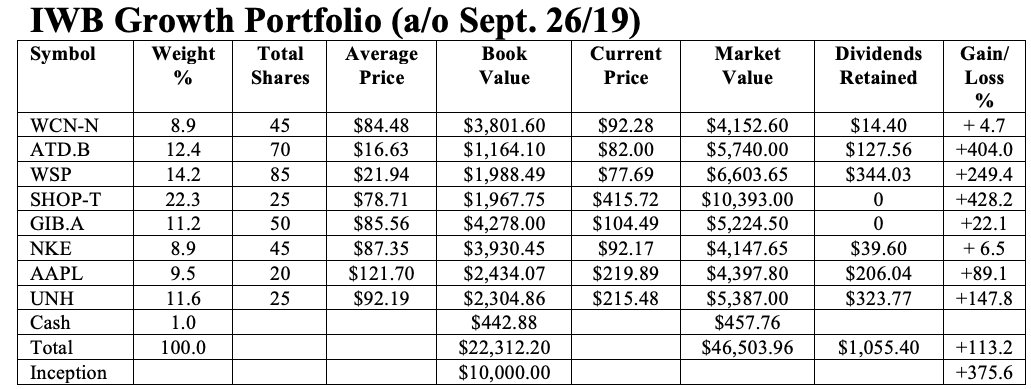

Here are the stocks that make up the current portfolio, with an update on how they have performed since our last review. Prices are as of the close on Sept. 26.

Waste Connections (NYSE: WCN). Collecting and disposing of garbage is not a glamourous business by anyone’s definition but it’s a profitable one. This stock was added to the portfolio in March. The shares are up US$3.80 since that time, plus we received dividends of US$0.32 per share, for a total return of 4.7% in a little over six months.

Alimentation Couche-Tard (TSX: ATD.B, OTC: ANCUF). This continues to be a big winner for us. The stock is up $5.72 since the last review in March. The quarterly dividend was raised by 25% to $0.125 effective with the March 27 payment.

WSP Global Inc. (TSX: WSP, OTC: WSPOF). This international engineering and technology firm saw its share price jump over $7 in the latest period. We received two dividends totaling $0.75 per share.

Shopify (TSX, NYSE: SHOP). Shopify stock went crazy over the summer, hitting a high of $543.76 at one point. Then reality set in and the shares pulled back to the current level. This is a great Canadian company but investors clearly overreacted. For accompany with no earnings it is still very expensive but at this level it is a more reasonable speculation. This stock does not pay a dividend.

CGI Group (TSX: GIB.A, NYSE: GIB). CGI was added to the portfolio a year ago at a price of $85.56 per share. Based in Montreal, it is the fifth largest independent information technology and business consulting services firm in the world. After taking a hit last December, the shares have recovered well and gained $15.25 in the latest period. CGI does not pay a dividend.

Nike (NYSE: NKE). Nike is the world’s leading manufacturer of sportswear. We added the stock last September at US$87.35 after an impressive growth spurt. The stock went into a slump almost immediately afterwards, falling as low as US$67.53 in December. It has since bounced back, gaining US$6.81 in the latest period. The next few months could be difficult, however, because of the U.S.-China trade war. We received two quarterly dividends of US$0.22 each.

Apple Inc. (NDQ: AAPL). This stock has been up and down all year. It dropped as low as US$173 in June but then recovered. Since our last review, it is up by US$44.85. This is normally not a volatile stock, but these are unusual times. We received two dividends for a total of US$1.54 per share.

UnitedHealth Group (NYSE: UNH). This stock has been in decline for the past year, dropping US$23.50 in the latest period, Politics has a role to play in this setback as several prominent Democratic candidates, including Elizabeth Warren and Bernie Sanders, are espousing the idea of Medicare-for-all. That would hit big insurers like UNH extremely hard. Despite that, the company continues to earn good profits and raised its dividend by 20% in June.

Cash. We received interest of $14.88 on our cash holdings in EQ Bank.

Here is how the portfolio stood at the close on Sept. 26. Commissions are not considered. The U.S. and Canadian dollars are treated as being at par but obviously gains (or losses) on the American securities are increased due to the significant exchange rate differential.

Comments: All the stocks in the portfolio posted gains with the exception of UnitedHealth Group. In spite of its recent pullback, the biggest gainer was Shopify, which saw its share price jump by $165.82. The net result was a gain for the portfolio of 17.6% over the latest period.

The total gain over seven years stands at 375.6%. That’s an average annual compound rate of return of 24.95%. I’ve said from the outset I don’t believe this is sustainable, but seven years is a good test of the durability of this portfolio.

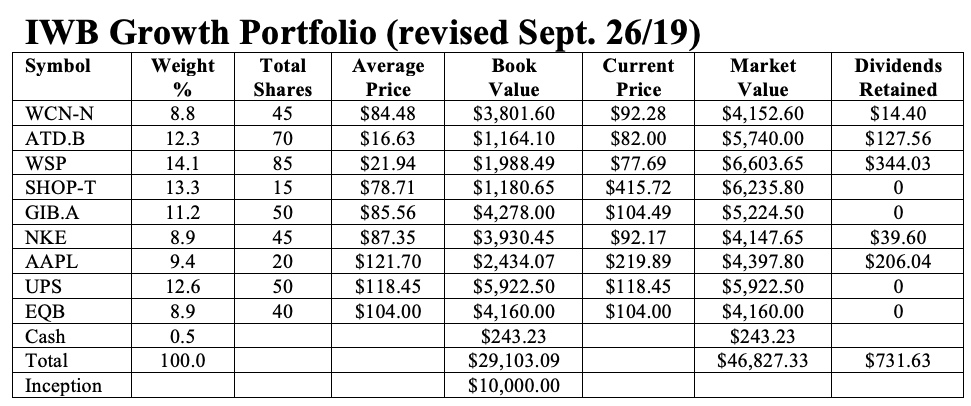

Changes: I have two concerns at this point. The first relates to UnitedHealth Group. This is a great stock and has done very well for us. However, the political threat hanging over it has caused investors to pull back and may not be resolved until the 2020 U.S. election, thus limiting its growth potential. Therefore, we will sell our position for a total of US$5,710.77, including retained dividends.

The second problem is the explosive growth of Shopify, which now accounts for 22.3% of the portfolio. That’s much too high, especially for a high-tech company that has yet to make a profit. Again, Shopify is a great firm, but this is putting too many eggs in one basket. We will therefore sell 10 shares for a total of $4,157.20. This leaves us with $9,867.97 to reinvest (treating the two currencies at par).

With stock markets so high and valuations extended, finding replacements with above-average growth potential is not easy.

But here are two companies with solid potential.

The first is Equitable Group (TSX: EQB), a Canadian mortgage lending service with a focus on entrepreneurs and recent immigrants. The company owns Equitable Bank, Canada’s ninth-largest Schedule 1 bank, and has had great success with its new digital subsidiary, EQ Bank. The stock is up 71% so far this year, in contrast to the Canadian banking sector as a whole, which has been trending down. Despite the strong price increase, Equitable trades at a reasonable p/e of 9.71 (trailing 12 months). We will buy 40 shares of Equitable Group at $104 for a total cost of $4,160.

Our second choice is United Parcel Service (NYSE: UPS). It’s the world’s largest package delivery company (yes, even bigger than FedEx) and is on the leading edge of new delivery technologies, especially in the healthcare sector. The shares are up almost 26% this year and the stock yields a decent 3.2%. We will buy 50 shares at a price of US$118.45 for a total cost of US$5,922.50.

Our total investment is $10,082.50. I’ve dividend the investments so they almost directly mirror the currencies we received from our sales. We will take $214.53 from cash to make up the difference. That will leave our cash balance at $243.23. With retained dividends, our total cash is now $974.86. We will move our account to Motive Financial, where that money can earn 2.8%.

Here is the revised portfolio. I will review it again in March.

Gordon Pape is Editor and Publisher of the Internet Wealth Builder and Income Investor newsletters. For more information and details on how to subscribe, go to www.buildingwealth.ca.