Smart Charity: Strategic Donations Maximize Both Gifts and Tax Breaks

If you want to give more money to a worthy cause and less to the Canada Revenue Agency (CRA), here are some strategies to keep in mind. Photo: Westend61/GettyImages

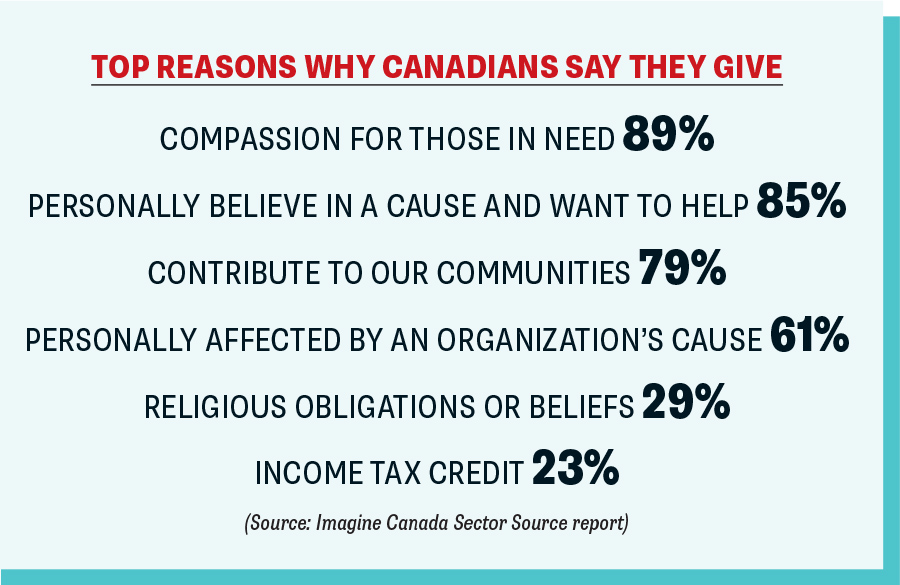

It stands to reason that more Canadians would give to charity if they knew about the tax advantages.

“By using charitable-giving strategies, you can minimize your taxes and maximize what you’re giving to causes that benefit the community,” says Andy Kovacs, a Markham, Ont.-based Sun Life financial planner.

Better yet, you don’t have to be rolling in it to become a savvy philanthropist. “You can create very significant gifts with small amounts,” notes Mark Halpern, a Toronto-based financial planner and CEO of WEALTHInsurance.com, a firm specializing in risk management and insurance solutions.

So if you want to give more money to a worthy cause and less to the Canada Revenue Agency (CRA), here are some strategies to keep in mind. (As some are more complex than others, you may want to discuss them with a financial adviser.)

What Can You Claim?

Donations of cash, securities or bequests to a registered charity will generate a tax receipt. However, don’t expect a receipt if you receive something in return for your donation, such as a meal, Girl Guide cookies, lottery tickets or membership fees.

PaperWork

When you file your return, claim your tax credit for any donations made to a registered charity by Dec. 31, 2020 or any unclaimed donations from the previous five years. Remember, this is a non-refundable tax credit, so you can only use it to reduce the tax you owe. (Hint: Using the CRA’s charity tax calculator will help determine whether it makes sense to claim your spouse or common-law partner’s donations.)

Federal and Provincial

Rates

The federal charitable tax credit rate is 15 per cent on the first $200 you donate and 29 per cent on everything above that. Provinces also provide charity tax credits, though their rates vary. For instance, if you live in Quebec (the province that offers the greatest incentives to give) and donate $1,000, you will receive a combined federal and provincial tax credit of $494, whereas those living in Ontario (the province that offers the least incentive) would only receive a combined credit of $361.38 for the same amount.

Wills and Bequests

“It’s very simple to include a gift to a charity for a specific dollar amount or a percentage of your estate,” says Kovacs. When the donor dies, their estate receives the tax credit. He says a good rule of thumb is to generate one dollar in tax savings for every two dollars you donate. “I had a client who left $10,000 in her will to a local animal shelter. This saved her estate $5,000 in taxes.”

Donating Securities

Kovacs also illustrates how donating listed Canadian stocks, ETFs or mutual funds can eliminate capital gains tax. “One client originally bought stocks for $10,000 and over the years its value appreciated to $50,000. Had he sold the stock at market value, he would have triggered capital gains tax on the $40,000 appreciation. However, by giving the stock ‘in kind’ to a charity, he avoided capital gains and received a tax receipt for the full $50,000. This saved him about $35,000 in taxes.”

Donating RRSPs/RRIFs

This is a strategy well suited to high-income donors, where they name a charity as the beneficiary of an RRSP or RRIF in order to eliminate tax owing on the registered money due upon their death.

Donating Insurance

Halpern, an expert in the use of life insurance for philanthropy, explains how this strategy worked for a client: “A retired accountant in his mid-60s had a $500,000 life insurance policy he wished to donate to his alma mater. An independent actuary valued the policy at $290,000, which he donated to the university. In exchange, he received a charitable donation receipt for the entire $290,000 and saved himself $145,000 in taxes.”

A version of this article appeared in the April/May 2021 issue with the headline Smart Charity, p. 56.

RELATED:

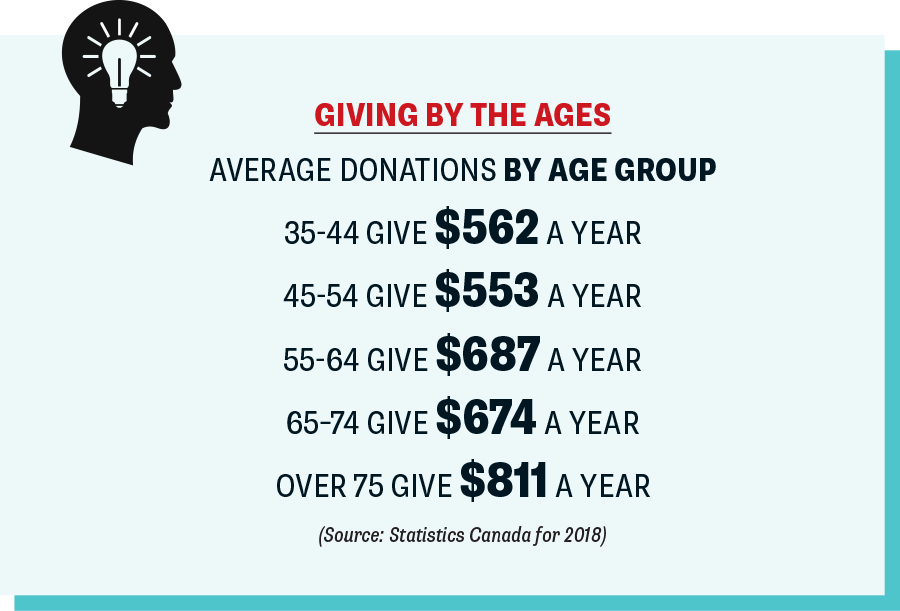

How the Generation That Gives Most to Charity Can Support Causes That Make a Meaningful Impact

How a Potential Spike in Inflation Will Affect Our Grocery Bills and Investments

Poll: Global Economy to Stage Vigorous Recovery; Jobs Growth to Lag