Navigating 2024 with Harvest ETFs: A Playbook for Monthly Cash Flow in Fixed Income

Learn how to generate Monthly Cash Flow in Retirement with Fixed Income ETFs

As the investment landscape rebounds from the 2023 turbulence, retirees and those nearing retirement eye fixed income as a stable haven. In response to soaring inflation rates, central banks initiated aggressive interest rate hikes, impacting equities and real estate. However, the savings landscape improved for the first time since the 2008 recession, prompting investors to reconsider fixed income.

In a promising turn of events, the Fed and the Bank of Canada signaled the likely conclusion of the rate hiking cycle in the latter half of 2023. With hints of potential rate cuts in 2024, this outlook could spark positive momentum and bolster bond prices, making fixed income an attractive option.

Harvest ETFs, with its commitment to consistently deliver a straight-forward, clear and cost-effective investment approach, has recently expanded their suite to include a comprehensive range of fixed income products. For the discerning Zoomer investor hungry for exposure to the flourishing fixed income space, Harvest ETFs present an enticing opportunity.

The “Happy Medium”: Harvest Premium Yield 7-10 Year Treasury ETF (HPYM:TSX)(HPYM.U:TSX)

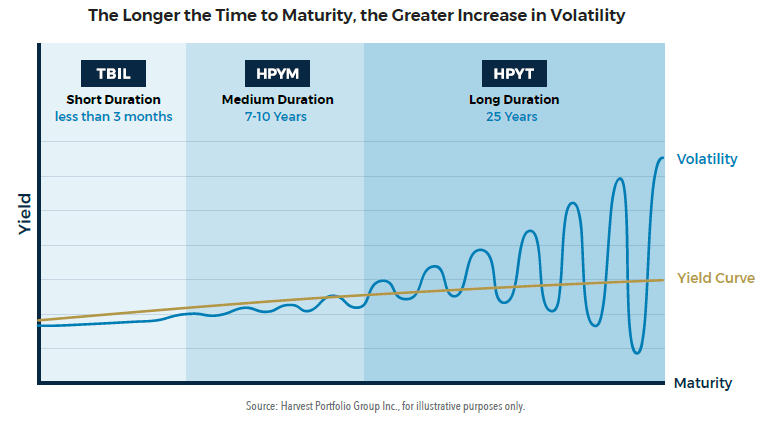

Introduced alongside TBIL, the HPYM ETF provides a balanced option within Harvest’s fixed income suite. Providing exposure to mid-duration U.S. Treasuries with average maturities of 7-10 years, by investing in US Treasury ETFs listed on North American Stock exchanges, this ETF seeks to deliver attractive and tax-efficient monthly cash distributions to investors, capitalizing on the stability offered by U.S. Treasuries.

The Long-Term High Yield Option: Harvest Premium Yield Treasury ETF (HPYT:TSX)(HPYT.U:TSX)

As the pioneer among Harvest fixed income ETFs, HPYT was launched on September 28, 2023, and focuses on longer-dated U.S. Treasuries with durations of 20+ years by investing in US Treasury ETFs. Leveraging covered call writing, it aims to generate higher yields and maximize monthly cash flow, offering investors a long-term high-yield option in a potentially volatile yet lucrative market.

Let’s not forget about Canadian retirees who want the best of both worlds: snowbirds. Snowbirds have the luxury of enjoying the hot and humid Canadian summers. When the Canadian weather turns, snowbirds turn south to enjoy hotter temperatures in the United States in places like Florida and California. This flexibility is a huge advantage for retirees who want to enjoy agreeable weather for the whole year round.

Snowbirds who want stability can look to protect themselves from currency fluctuations by owning shares in US Dollars. Fortunately, snowbirds are covered with the availability of U Class shares for both HPYM and HPYT.

In a year poised for economic shifts, Harvest ETFs provide a strategic toolkit for investors seeking monthly cash flow through fixed income, embodying simplicity, transparency, and cost-effectiveness.

FOLLOW US ON SOCIAL MEDIA:

LinkedIn

YouTube

TikTok

Facebook

Instagram

Twitter

Spotify

FOR ADDITIONAL INFORMATION:

Website: https://harvestetfs.com

E-mail: [email protected]

Toll-Free: 1-866-998-8298

Stay Informed

Disclaimer

For Information Purposes Only. Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The ETF is not guaranteed, its values changes frequently and past performance may not be repeated. This communication should not be considered as advice and/or a recommendation to purchase or sell the mentioned securities or used to engage in personal investment strategies. Tax, investment and all other decisions should be made with guidance from a qualified professional.

Certain statements in this communication are forward looking Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS.FLS are not guarantees of future performance and are by their nature based on numerous assumptions, which include, amongst other things, that (i) the Fund can attract and maintain investors and have sufficient capital under management to effect their investment strategies, (ii) the investment strategies will produce the results intended by the portfolio managers, and (iii) the markets will react and perform in a manner consistent with the investment strategies. Although the FLS contained herein are based upon what the portfolio manager believe to be reasonable assumptions, the portfolio manager cannot assure that actual results will be consistent with these FLS. Unless required by applicable law, Harvest Portfolios Group Inc. does not undertake, and specifically disclaim, any intention or obligation to update or revise any FLS, whether as a result of new information, future events or otherwise.