Canada’s Largest Healthcare ETF: Nearly a Decade of Monthly Income

Seek growth and monthly income with exposure to top US healthcare stocks

Apart from technology, healthcare has been one of the most dependable sources of growth for investors in the 21st century. Now, in 2024, healthcare is the beneficiary of several key growth drivers that should propel this space for many years to come. Canadian investors who are hungry for exposure to this growth sector, and who desire steady monthly income, may want to consider the Harvest Healthcare Leaders Income ETF (HHL:TSX).

In this piece, we’ll look at the key growth drivers in healthcare and explore what makes HHL stand out compared to its peers. Let’s jump in.

Growth drivers in the healthcare space

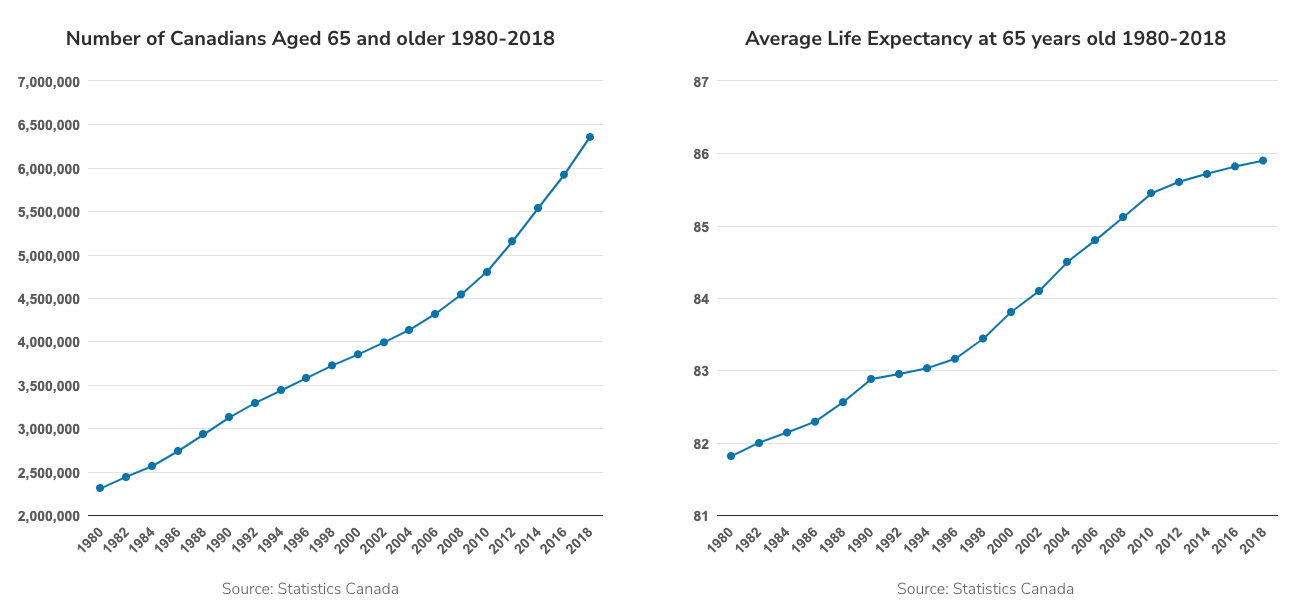

One of the main growth drivers in the healthcare sector is the rapidly aging population in the developed world. According to the World Health Organization (WHO), by 2030, 1 in 6 people in the world will be aged 60 years or over. Moreover, the share of the population aged 60 years and older will double (2.1 billion). Meanwhile, the number of persons aged 80 years or older is projected to triple between 2020 and 2050, reaching 426 million.

The trend of aging populations started in high-income countries like Japan and Germany. However, this trend has now expanded to low-and-middle-income countries. These are now the countries that are seeing the greatest demographic change in the realm of aging populations. By 2050, the WHO projects that two-thirds of the world’s population over 60 years will live in low-and-middle-income countries.

Some common health conditions in older age include hearing loss, cataracts and refractive errors, back and neck pain and osteoarthritis, chronic obstructive pulmonary disease, diabetes, depression, and dementia. In advanced age, people are more likely to experience several conditions at once.

Why healthcare is also a defensive play

Healthcare is a genuine defensive play due to its resilient and inelastic demand. Indeed, demand in this space is generally uninfluenced by external factors and price increases that have the potential to negatively impact other sectors. For example, high inflation in Canada and other countries has driven up the price of goods, making products like clothing less affordable. People can avoid purchasing new clothes or electronics, but medications fall into the category of necessary spending.

In many developed countries, like Canada and Germany, the state as well as insurance companies are the entities bearing the burden of prescription drug prices. That means that these entities pay for constants like doctor visits, hospitalization, and partially or fully reimburse the cost of medications.

Combining these factors with an aging population is the winning recipe to keep demand for healthcare high, making the healthcare sector a promising investment target.

What makes the Harvest Healthcare Leaders Income ETF stand out in 2024

The Harvest Healthcare Leaders Income ETF targets US healthcare companies that combine innovation with consistent demand. Because the need for healthcare is ubiquitous, the sector presents opportunities for growth and when combined with Harvest’s option strategy, it offers the potential for consistent monthly income generation. So, HHL offers that blend of steady income and growth opportunities from large-cap US healthcare leaders.

GLP1s, or weight-loss drugs as they are commonly referred to, are a potential game-changer in the healthcare space. Harvest ETFs Chief Investment Officer, Paul MacDonald, recently joined Harvest Market Minutes to explain why the healthcare sector offers an opportunity in the shorter and longer term and explores the promising potential of weight-loss drugs.

HHL targets 20 equally weighted large capitalization stocks. In constructing the portfolio, the manager seeks out strong companies with a drive for innovative solutions. One of its holdings recently received an approval from the US Food and Drug Administration (FDA) for an innovative drug targeting chronic weight loss management. This development has the potential to contribute to breakthroughs in the prevalence of heart disease, sleep apnea, and other health issues associated with overweight and obesity. Another of its holdings is a company with a diverse revenue base, selling its products to over 100 countries around the world as well as third-party distributors and dealers.

HHL employs a covered call strategy to enhance portfolio income potential and lower portfolio volatility. This ETF has paid over C$400 million in cash distributions since inception and its Canada’s largest healthcare ETF with approximately C$1.5 billion in assets under management (AUM). It has paid out a monthly distribution of $0.0583 per unit for nearly a decade. That represents a current yield of 8.47% as at February 13, 2024.

Want more monthly cashflows? Consider an enhanced income healthcare ETF

Harvest has an impressive line-up of Enhanced Equity Income ETFs. These ETFs offer leveraged exposure to select Harvest Equity Income ETFs, which are non-levered and write option on up to 33% their holdings. Through the application of approximately 25% leverage, the Enhanced Equity Income ETFs seek to deliver higher monthly cashflows and growth potential and have slightly higher risk rating, relative to the Equity Income ETFs they invest in.

The Harvest Healthcare Leaders Enhanced Income ETF (HHLE:TSX) is one such. It is built to deliver enhanced income and growth opportunities by applying modest leverage to an investment in HHL. It offers access to the same portfolio of large-cap US healthcare companies with enhanced monthly cashflow.

This ETF last paid out a monthly distribution of $0.0913 per unit. That represents a current yield of 10.5% as at February 13, 2024.

FOLLOW US ON SOCIAL MEDIA:

LinkedIn

YouTube

TikTok

Facebook

Instagram

Twitter

Spotify

FOR ADDITIONAL INFORMATION:

Website: https://harvestetfs.com

E-mail: [email protected]

Toll-Free: 1-866-998-8298

Stay Informed

Disclaimer

For Information Purposes Only. Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The ETF is not guaranteed, its values changes frequently and past performance may not be repeated. This communication should not be considered as advice and/or a recommendation to purchase or sell the mentioned securities or used to engage in personal investment strategies. Tax, investment and all other decisions should be made with guidance from a qualified professional.

Certain statements in this communication are forward looking Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS.FLS are not guarantees of future performance and are by their nature based on numerous assumptions, which include, amongst other things, that (i) the Fund can attract and maintain investors and have sufficient capital under management to effect their investment strategies, (ii) the investment strategies will produce the results intended by the portfolio managers, and (iii) the markets will react and perform in a manner consistent with the investment strategies. Although the FLS contained herein are based upon what the portfolio manager believe to be reasonable assumptions, the portfolio manager cannot assure that actual results will be consistent with these FLS. Unless required by applicable law, Harvest Portfolios Group Inc. does not undertake, and specifically disclaim, any intention or obligation to update or revise any FLS, whether as a result of new information, future events or otherwise.