Stock Market: Another Big Gain for Buy and Hold

This Buy and Hold Portfolio has a very simple goal – invest in great stocks and then hold on to them, no matter what the market is doing. Photo: stevepb/pixabay

The great thing about bull markets is that you don’t have to do anything to make money. As long as you’ve chosen good stocks for your portfolio, you can keep riding the rising tide to bigger profits. Of course, when the market turns around it’s a different story. But right now, things are going in our favour.

I created this Buy and Hold Portfolio for my Internet Wealth Builder newsletter seven and a half years ago, in June 2012. It has a very simple goal — invest in great stocks and then hold on to them, no matter what the market is doing. Over the long term, the strategy works. There are ups and downs, of course, but the underlying thesis is that the long-term trend of the markets is up. If you own good stocks, they’ll move with it.

This portfolio consists mainly of blue-chip stocks that offer long-term growth potential. It also has a small fixed-income holding. The original weighting was 10 per cent for each stock with a bond ETF that started with a 20 per cent position but has now been reduced because equity increases have outpaced the bond market.

I used several criteria to choose the stocks. These included a superior long-term growth profile, industry leadership, good balance sheet, and relative strength in down markets.

The objective is to generate decent cash flow (all the stocks but one pay dividends), minimize downside potential, and provide slow but steady growth. The target rate of return is 8 per cent annually.

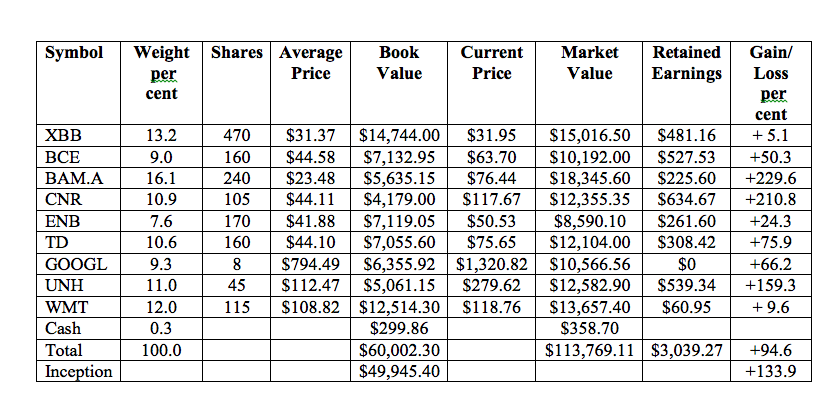

These are the securities we hold with comments on how they performed since my last review in June. Prices are as of the afternoon of Dec. 4.

iShares Canadian Universe Bond Index ETF (TSX: XBB). After a strong rebound in the spring, the unit price stabilized in the latest six-month period, gaining just $0.11. We received six monthly distributions totalling $0.444 per unit.

BCE Inc. (TSX, NYSE: BCE). BCE shares continued to move higher, adding $1.18 since our last review. We received two dividends of $0.7925 each.

Brookfield Asset Management (TSX: BAM.A, NYSE: BAM). Brookfield shares took a huge jump in price during the period, rising $13.29 or 21 per cent. That’s an impressive move for a mature company of Brookfield’s size. We received two dividends totalling US$0.32 per share during the period. Total return over the latest six months was 21.6 per cent.

CN Rail (TSX: CNR, NYSE: CNI). CN shares reached a high of $127.96 earlier this year but the recent strike hit the stock on expectations of weaker fourth-quarter earnings. Because of timing, we received only one dividend in the period, of $0.5375 per share.

Enbridge (TSX, NYSE: ENB). Enbridge continues to move higher, with the stock gaining $4.94 in the latest period. We received two dividends for a total of $1.476 per share.

Toronto Dominion Bank (TSX, NYSE: TD). The stock has pretty much marked time since our last review, gaining a meagre $0.65. We received two dividend payments for a total of $1.48 per share.

Alphabet (NDQ: GOOGL). After a lacklustre first half of the year, Alphabet stock has been on a run, gaining US$241.72 in the latest period. More details in an update elsewhere in this issue. This is the only stock in the group that does not pay a dividend.

UnitedHealth Group (NYSE: UNH). Investors seem to have discounted the threat to the U.S. health insurance system from the left wing of the Democratic party and this stock rebounded by $35.12 in the latest period. The quarterly dividend was increased by US$0.18 a share (20 per cent) and we received two payments totalling US$2.16 per share.

Walmart (NYSE: WMT). We dropped the Walt Disney Company from the portfolio in June after contributing editor Glenn Rogers advised selling the stock for a 200 per cent gain. Walmart was added in its place and is off to a good start with a total return of 9.6 per cent in its first six months.

Cash. At the time of the last review, our cash reserves, including retained dividends, were $2,195.92. We invested that money at 2.8 per cent in a Savvy Savings account with Motive Financial, earning $30.74 in interest.

Here is the status of the portfolio as of the afternoon of Dec. 4. For consistency, the Canadian and U.S. dollars are considered to be at par. However, the currency differential increases U.S. dollar gains (or losses) for Canadians. Trading commissions are not factored in although in a buy and hold portfolio they are not significant in any event.

Gordon Pape’s Buy and Hold Portfolio (updated Dec. 4/19)

Comments: The new portfolio value (market price plus retained dividends/distributions) is $116,808.38, compared to $106,964.02 at the time of the last review. That represents a gain of 9.2 per cent over the period, which is well beyond our goal.

All of our securities turned in gains in the period, with the sole exception of CN Rail.

Since inception, we have a total return of 133.9 per cent. That represents an average annual compound growth rate over seven and a half years of about 12 per cent, which is well ahead of our 8 per cent target.

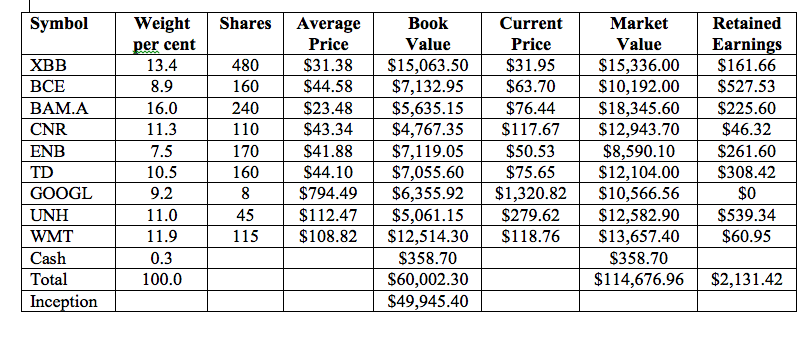

Changes: This is a Buy and Hold portfolio, so I am not making any changes to our holdings. However, we will add to our positions in these securities:

XBB – We will buy 10 units at $31.95 for a cost of $319.50. That will bring our position to 480 units and reduce our retained earnings to $161.66.

CNR – We will purchase another five shares while the price is down for a cost of $588.35. We now own 110 shares. Retained earnings are reduced to $46.32.

We will move our cash of $2,490.12 over to Laurentian Bank, which is currently offering 3.3 per cent on digital deposits.

Here is a look at the revised portfolio. I will update it again in June.

Gordon Pape’s Buy and Hold Portfolio (revised Dec. 4/19)

Gordon Pape is Editor and Publisher of the Internet Wealth Builder and Income Investor newsletters. For more information and details on how to subscribe, go to www.buildingwealth.ca.

Follow Gordon Pape on Twitter at twitter.com/GPUpdates and on Facebook at www.facebook.com/GordonPapeMoney

RELATED:

Choosing a Retail Stock In a Changing Landscape

Q&A With Gordon Pape: What Are Some Recession-Resistant Stocks?